In a hot, humming hall at the University of Pennsylvania, ENIAC’s 19,000 vacuum tubes crackled to life in 1945 and threw off a glow like a furnace door.

They called it a Giant Brain, but it sounded more like something that tracked weather patterns.

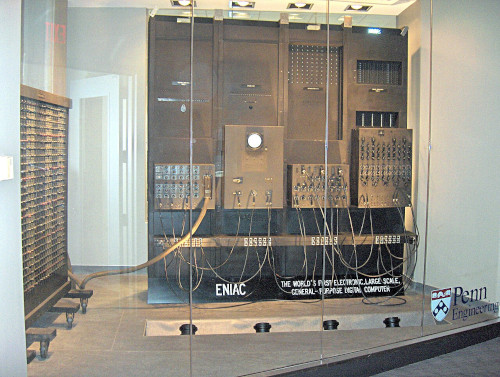

Here’s a look at what this early technical Frankenstein looked like:

To finish the arduous task, teams of human “computers” rerouted cables and twirled dials to teach the machine new tricks, each program a choreography of plugs and pulses.

There was no doubt that ENIAC was built for one purpose — to win a war.

However, our first programmable, digital computer ended up giving birth to the modern data center, a machine that filled a room, weighed more than thirty tons, and drank electricity as if it had a thirst — on the order of nearly 200 kilowatts. And that was the first sign of a developing problem.

Reporters at the time grasped for a metaphor, breathlessly writing about a room that could think on its own.

Well, they weren’t wrong.

The Best Free Investment You’ll Ever Make

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

Just about 80 years later, that thinking room has expanded into private city-states of computation.

While ENIAC sipped hundreds of kilowatts, today’s AI data centers guzzle hundreds — even thousands — of megawatts, enough to redraw utility maps and politics in the places they land.

Recently in West Texas, a new project backed by CoreWeave and Poolside, sketches a 2-gigawatt horizon with an initial half-gigawatt phase tied directly to Permian Basin gas. Over in Virginia, counties are actively rezoning to bundle data centers with their own gas peakers — and even future small modular reactors — to keep the lights steady when algorithms don’t sleep.

Of course, grid planners in Texas are planning for a decade of aggressive growth for data centers, and are already warning us that peak power demand records are tumbling as quickly as the headlines roll in.

From a 200-kilowatt “Giant Brain” to multi-gigawatt AI citadels, the arc is clear — and the appetite is a very specific type of electricity: Baseload power.

If that feels like the beginning of a new era, it is.

Today, the AI scale-up is no longer a thing of hopes and dreams; it’s arriving with bulldozers, balance sheets, and backup turbines.

And even though we’re moving toward a “bring your own power” era, where hyperscalers and AI specialists are planning on-site generation because interconnection queues and grid bottlenecks can’t match their timelines, that future is still years away.

Until next-gen nuclear technology like SMRs become a reality (remember that small modular reactors have a long way to go before they start providing power to data centers) there are only a few power options left.

The logic is brutally simple.

You see, AI loads are round-the-clock, price-insensitive, and now too big to be politely queued behind everyone else’s megawatts. That’s why your morning headlines now include phrases like “energy Wild West,” and why county boards from Virginia to Pennsylvania are rezoning to bundle data centers.

Grid operators are starting to rewrite their math just to keep up. ERCOT’s own filings show how violently the estimates have moved, with its 2030 forecasts showing data-center load more than doubling to 78 GW — a revision so large the market’s “sanity check” had to change the methodology just to keep public planning tethered to plausibility.

Meanwhile, PJM — the Mid-Atlantic giant that includes northern Virginia’s Data Center Alley — now pegs nearly all of its 32 GW peak-load growth this decade to data centers, and capacity auction prices have rocketed to the system cap as reliability risk reprices.

In other words, the biggest power markets in America are budgeting for AI demand first and asking generators to meet it!

That’s why the near-term fuel mix matters, folks.

So where does a rational investor hunt while everyone else argues about a future that isn’t hooked to the grid yet? That’s easy, you start with the right energy source, THEN location.

The EIA just flagged record U.S. natural-gas consumption for 2025 and fresh peak-demand records this summer, while coal keeps stepping off the stage with another wave of retirements this year and more through 2035.

Nuclear can and will carry weight, but most new nuclear in the U.S. is still on the license-paperwork side of the river. TVA’s Clinch River SMR is in NRC review through late 2026, and the first Amazon-backed SMR fleet in Washington remains a plan on paper rather than an operating baseload plant.

Between now and the first truly commercial SMR deployments, the burden falls on abundant U.S. gas and the existing nuclear fleet.

If you connect those dots, you’ll see the opportunities start to emerge.

And if you find the operator that sits at the intersection of both of these — supplying the right power in the right places as AI’s appetite turns from headlines into invoices — you won’t need a Giant Brain to recognize the true value for what it is.

I suggest starting your due diligence here.

Until next time,

Keith Kohl

A true insider in the technology and energy markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital, as well as the investment director of Angel Publishing’s Energy Investor and Technology and Opportunity.

For nearly two decades, Keith has been providing in-depth coverage of the hottest investment trends before they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on key advancements in robotics and AI technology.

Keith’s keen trading acumen and investment research also extend all the way into the complex biotech sector, where he and his readers take advantage of the newest and most groundbreaking medical therapies being developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s to lab scientists grinding out the latest medical technology and treatments. You can join his vast investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.